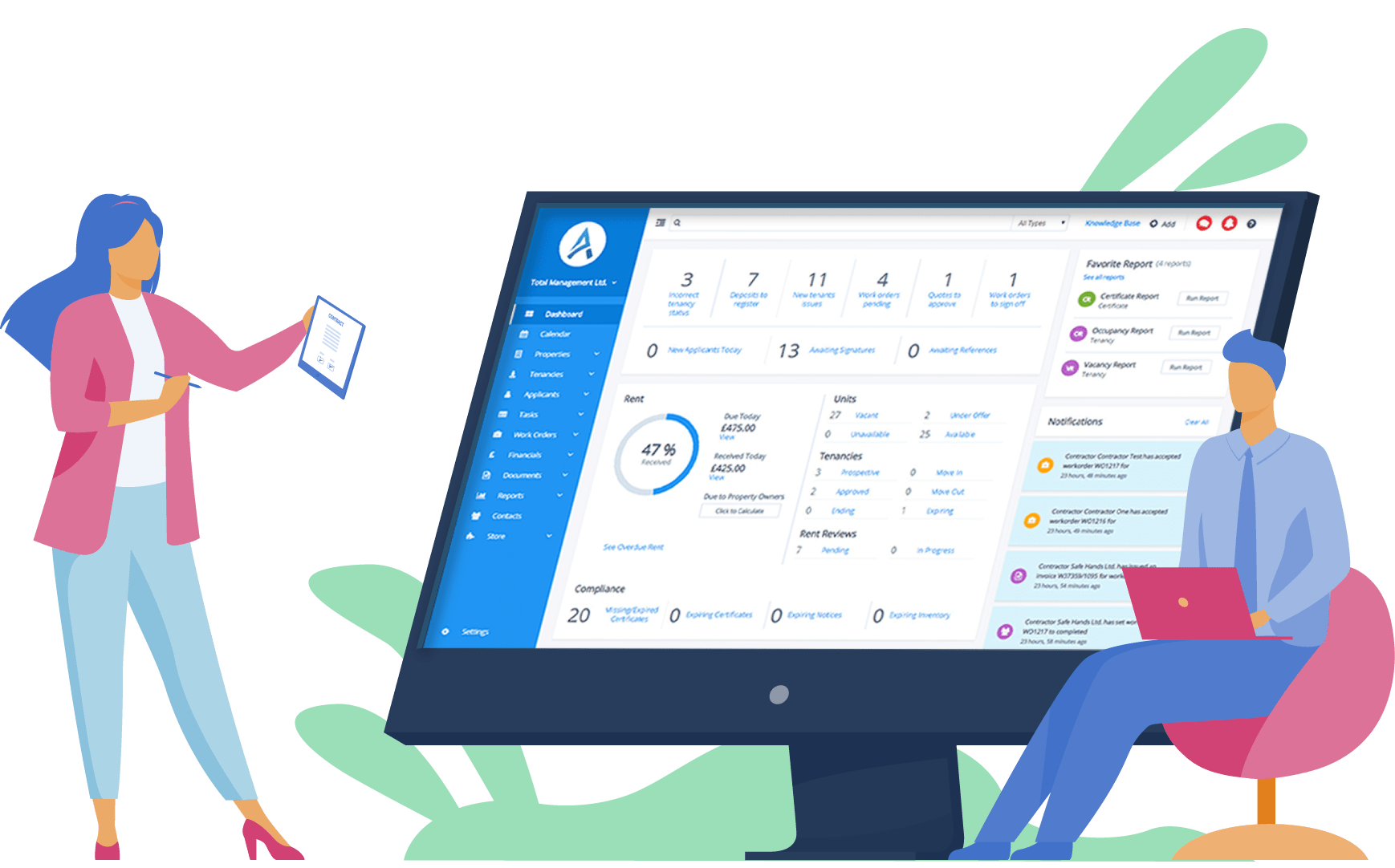

Property management software made simple

Arthur is an award-winning property management software designed to save your business time and money by streamlining each stage of the tenancy journey. Boost efficiency, increase your revenue and grow your portfolio.

* no credit card required

Helping you get more done

The only software on the market where you can seamlessly manage all stakeholders with dedicated apps.

320000 +

Tasks completed

200000 +

Registered users

145000 +

Units listed

Be fully connected

Seamlessly manage all stakeholders

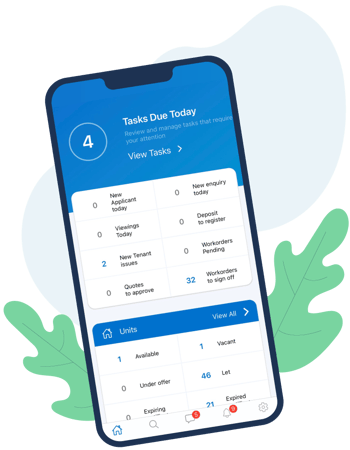

Property manager

Stay in control on-the-go

Access key data and complete business-vital tasks wherever you are, helping you manage your portfolio whenever, wherever.

Occupant

Ensure transparency and efficiency

A self-service portal for occupants to report maintenance issues, view documents, receive reminders and more.

Contractor

Everything you need to get the job done

Grant contractors access to all the information they'll need to complete the job.

Property owner

A viewing gallery for peace of mind

Make property owners feel confident that their assets are being well managed by keeping them updated.

Integrate with thousands of apps

Everything you use, connected. Effortlessly integrate with a full suite of market leading online tools.

Manage your finances

All your information on one dedicated financial console, directly integrated with market leading cloud accounting software

- Manage rent

- Produce occupant and property owner statements

- Integrate with Xero

Get the most out of your business

Arthur's powerful automation engine is designed to revolutionise your business. By systemising your workflows and offering powerful reporting, Arthur can save you hundreds of work hours, and we can even put everything in place for you

Client reviews

Latest articles

Read more on

#{ item.name }

#{ truncateText(item.metadescription) }

-1.png)