Student Housing vs Private Rental

For property managers, the decision between which type of tenant you want to cater to can be challenging. The choice between students and non-students is complex; student lets offer high yields but are considered slightly more risky. Private lets allow for more flexibility but require considerable amounts of admin, therefore the decision is one to be carefully thought over.

Student housing:

Providing accommodation for students has been increasingly popular due to rising enrolment rates at UK universities, indicated by the 31,348 (2.26%) student beds increase for the 2018/19 academic year from the previous year. Looking at historical figures, the long term increase in demand for student accommodation has been considerable; since 1999 the UK student rental market has seen a 61% increase in demand for accommodation, from 670,000 students back in 1999 to 1.1 million students now in 2019. (Cushman & Wakefield).

Student housing offers a range of benefits for property managers:

- Student demand for housing is inelastic against economic performance, meaning you won’t find yourself with lots of empty units if a recession / economic slowdown happens. The student market is also predictable, planning tenancies is made simple due to seasonal demand, contracts last 9-12 months, starting before the first academic semester commences in September.

- Furthermore, the nature of student lets offer high returns as they tend to live together under one roof, maximising revenue per property. Additionally, the property is exempt from council tax for students and reduces costs for owners of up to 25% on their council tax bill. [local government finance act 1992]

- Student accommodation agreements typically have joint liability with individual guarantors, which means that if there is a group of students living together, and one leaves, then the other students and their guarantors are liable for the full payment of the rent.

One important factor to consider in deciding whether you should focus on the student market is the location of property. Students decisions are heavily influenced by the distance of the property from the university campus or facilities.

However, there are some risks with providing student accommodation, just like there are with all types of accommodation. Students are often seen as a greater risk mainly due to their lack of financial history:

- Students can be unreliable with payments, as they rely on loans/grants. It’s common for students to run out of money during their tenancy therefore needing to find other sources of finance (often parents). This risk is however mitigated considerably by the requirement of guarantors to student accommodation contracts.

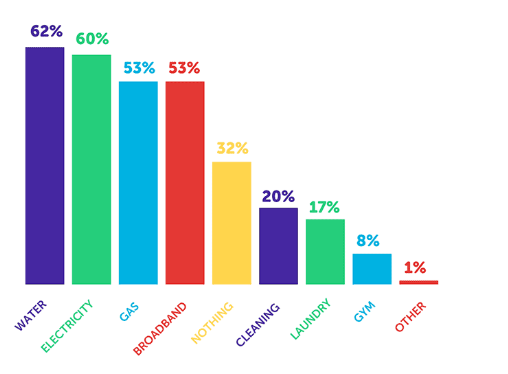

- Students almost always require the property to be furnished, which adds to the costs of renting students, however, the additional costs are more than compensated when considering the returns. Below is a chart that shows what is typically included in student rent.

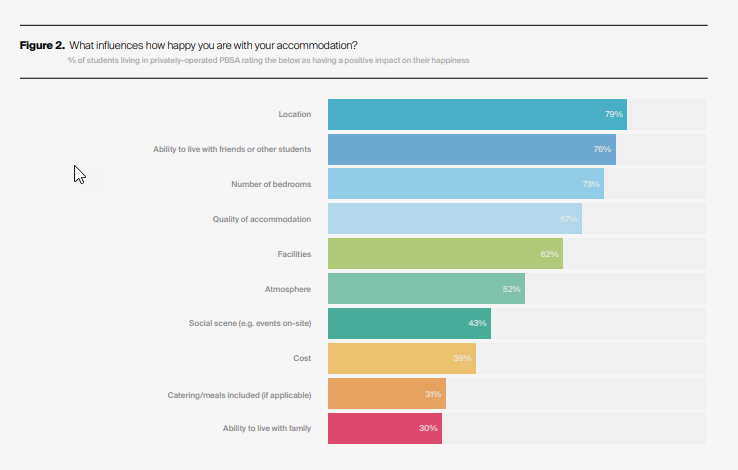

Students can have high expectations that need to be met. 82% say fast internet is important when selecting a property.71.9% find inclusive bills as important, as 1 in 10 students have had to pay someone else’s bill in the past. These needs must be met to attract students. [Rightmove]

- Property managers typically cannot check reports about the students, as there aren’t previous landlord/income references to look to to help decide if they are a suitable prospective tenant. However, credit checks can be conducted on the guarantors.

- Seasonal demand means that properties are left empty in the summer months between university. Tenancies typically commence in September at the start of the academic year and lasts 9 months, resulting in a gap between. If you miss the window of opportunity to sign a tenant, you can be left with an empty unit for a whole year.

Private rental:

Private rental offers a different proposition to student accommodation, and the benefits of private are:

- Property managers are able to vet tenants via credit checks and previous tenant references. By knowing an applicant’s history, it enables you to make a better-informed decision, and spot any red flags when selecting tenants.

- Private rental offers the chance of long-term tenancy agreements, which sometimes can last longer than 1 year, allowing property managers and owners to gain a steady income stream.

- There is great variety for furnishing, you can rent unfurnished, part-furnished or fully furnished, giving you the flexibility to rent what you want to. With unfurnished properties, it means less responsibility, for example no more taking inventories or dealing with replacing/ repairing broken or damaged items.

Just like student accommodation, private rental also comes with its own contrasting set of disadvantages:

- Firstly, it can be harder to organise your tenancy administration in comparison to student lettings. While in a positive scenario a property can get a tenant that is looking for long-term accommodation, there is also the danger that tenants can move in and out throughout the year, as opposed to the occupancy guarantee of student accommodation based on the academic year. AST contract lengths can vary, typically from 3 months to 12 months.

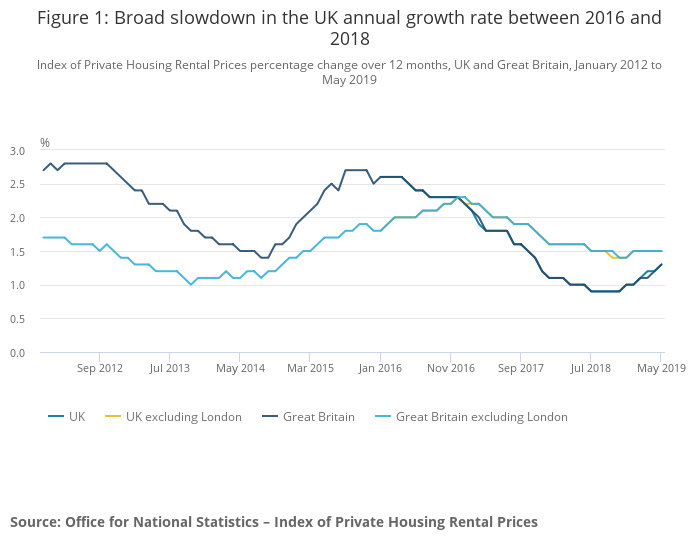

As a property manager, your number one priority should be to always have your units occupied. The private rental market is more responsive to economic factors. Unless the property is in a prime location for commuting, there is no guarantee that if it were to become available, it would be rented immediately and you wouldn’t experience any void periods.

Conclusion

To conclude, the decision between to two options is influenced by the aforementioned factors. All property investment and management comes with risks, be it student or private rental tenants, or any other type of tenancy. However, they both offer great benefits too, and managed correctly, can bring great returns. It’s important for property managers to mitigate the risks in their market, so when it comes to students, ensuring there is joint liability with student contracts, and property managers and owners can purchase rental guarantee insurance for private rental, and do credit-checks and tenant referencing. Doing so will greatly enhance the likelihood of smooth tenancies and good financial returns.