How to handle Deposits held in a Custodial Scheme (Quickbooks Users)

Creating the deposit control accounts in Arthur & QuickBooks

If you are going to operate using a Custodial Scheme to deal with your tenants deposits, you must first set up the deposit control account in Arthur.

Step 1:

Select “Financials” from the subheadings followed by Bank Accounts. From here select “Add Bank Account” and set up as follows. Adjust the custodial section of the name to any alternative named scheme that you may use.

Step 2:

Map Arthur Bank Account to QuickBooks

- Select Financials > Go to QuickBooks Screen > Mapping Bank Accounts

- Map the QuickBooks Online Bank Account “Arthur Custodial Scheme” to the Arthur Payments/Bank Accounts “DPS custodial”

- Save the mapping

Step 3:

Synchronise Arthur and QuickBooks. You will now be able to find and use this account in QuickBooks.

How to Account for Registered Deposits

Step 1:

Go into the Tenancy > Add Transaction type “Registered deposit charge”. This will create the charge on the tenant deposit statement.

Select Save Transaction then conduct a synchronization between Arthur and QuickBooks

Step 2:

Go into QuickBooks > Banking and match the the bank line with the relevant deposit invoice posted by Arthur.

Step 3:

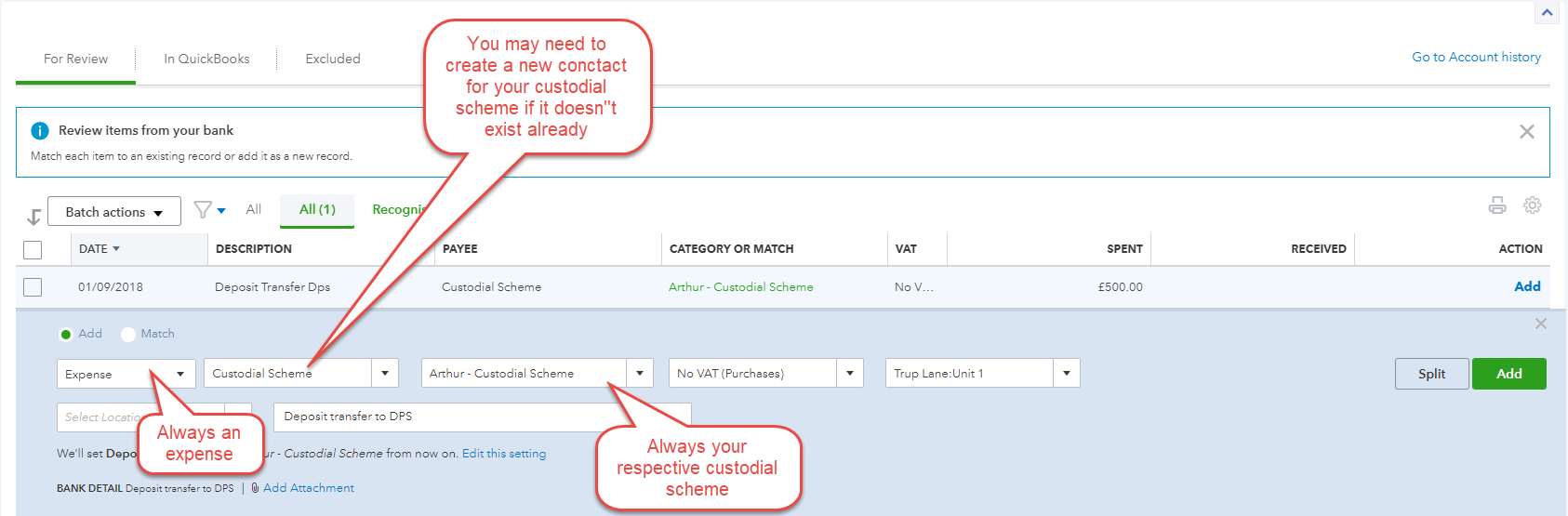

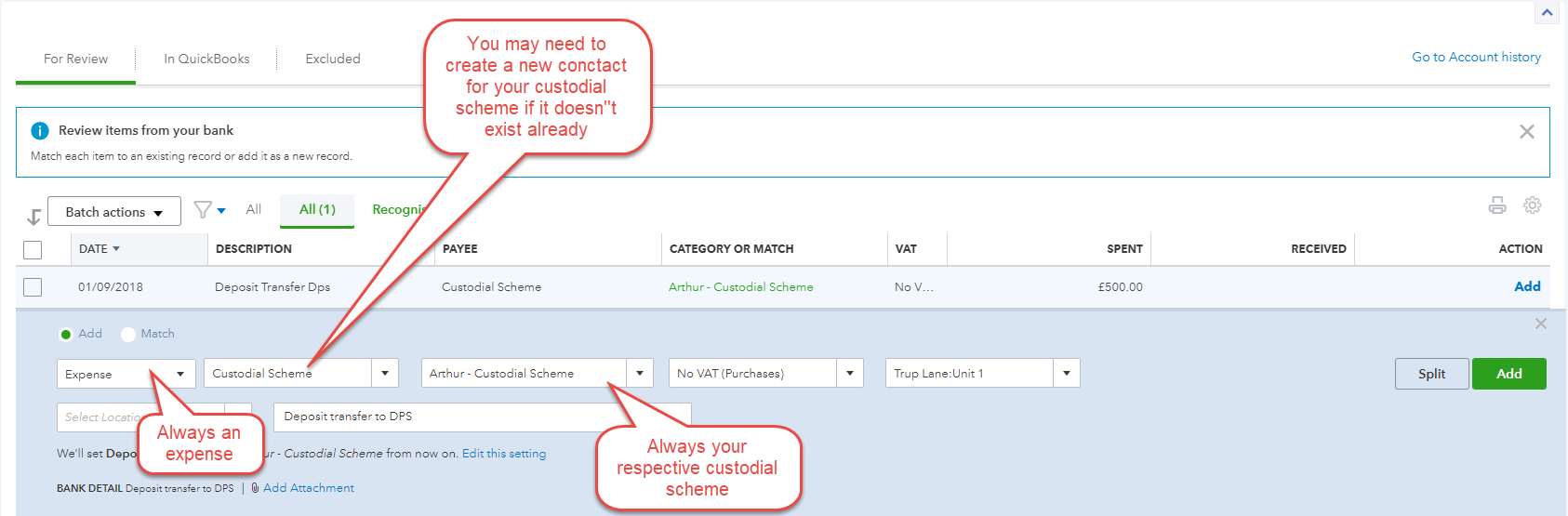

Once you conduct a bank transfer to the custodial scheme (in real life), you will be met by a spent item in QuickBooks.

From here, you would select the Transaction and fill in the fields as follows;

- Transaction Type: “Expense”

- Select Payee: “Custodial Scheme” contact (You may need to create a new supplier contact e.g. DPS. Mydeposits etc.)

- Account: “Arthur – Custodial Scheme” (Insert/choose your respective custodial scheme) – This is the account created in the first section – How to Set Up your Deposit Custodial Account

- Select VAT

- Select Class: You will need to select the relative unit

- Description: Tenant Name, Tenancy ID, Unit Address (Deposit transfer to “Custodial Scheme”)

Complete this by using the “Add” feature in QuickBooks. This will credit the Custodial Scheme Account.

How to Refund Tenants Deposits Directly Held with Custodial Scheme

Step 1:

Carry out the closing tenancy as shown in the article

No entry will go through the bank account in QuickBooks as the credit will be created in QuickBooks as a credit to the custodial account.

If you are refunding the tenant directly, select your client bank account as the ‘Remittance bank account'( in the image above). You can then reconcile the tenant remittance transaction against the payments (refund) made to the tenant on QuickBooks.

Step 2:

In QuickBooks (this will be after you sync)

Go onto your Banking page. If there are any deductions, the Custodial Scheme will send you the funds directly. You must deal with these in order to level off the nominal account within Arthur. Find the received item from the Custodial Scheme and follow these steps

In…

Payee – Select the custodial scheme

Category – The Account set up for your custodial scheme

Memo – Description

Class – Tracking codes for unit and properties

Financials & ReportingAll your property financials & reporting within one simple software

Financials & ReportingAll your property financials & reporting within one simple software Applicant Viewing & ManagementManage applicants & viewings seamlessly with our easy to use tools

Applicant Viewing & ManagementManage applicants & viewings seamlessly with our easy to use tools Task ManagementBringing sanity to chaos with our effortless task management features

Task ManagementBringing sanity to chaos with our effortless task management features Property ManagementFor all property types from commercial to residential and block management

Property ManagementFor all property types from commercial to residential and block management Stakeholder ManagementConnect with stakeholders from anywhere using Arthur’s suite of mobile apps

Stakeholder ManagementConnect with stakeholders from anywhere using Arthur’s suite of mobile apps Document ManagementTake full control of your document management in one secure place

Document ManagementTake full control of your document management in one secure place Occupancy ManagementMaking the occupancy process as smooth as possible from start to end

Occupancy ManagementMaking the occupancy process as smooth as possible from start to end Workflow ManagementGet the job done, quickly, efficiently with our workflow management tools

Workflow ManagementGet the job done, quickly, efficiently with our workflow management tools

+44(0)20 7112 4860

+44(0)20 7112 4860