- Features

Product FeaturesFind out more

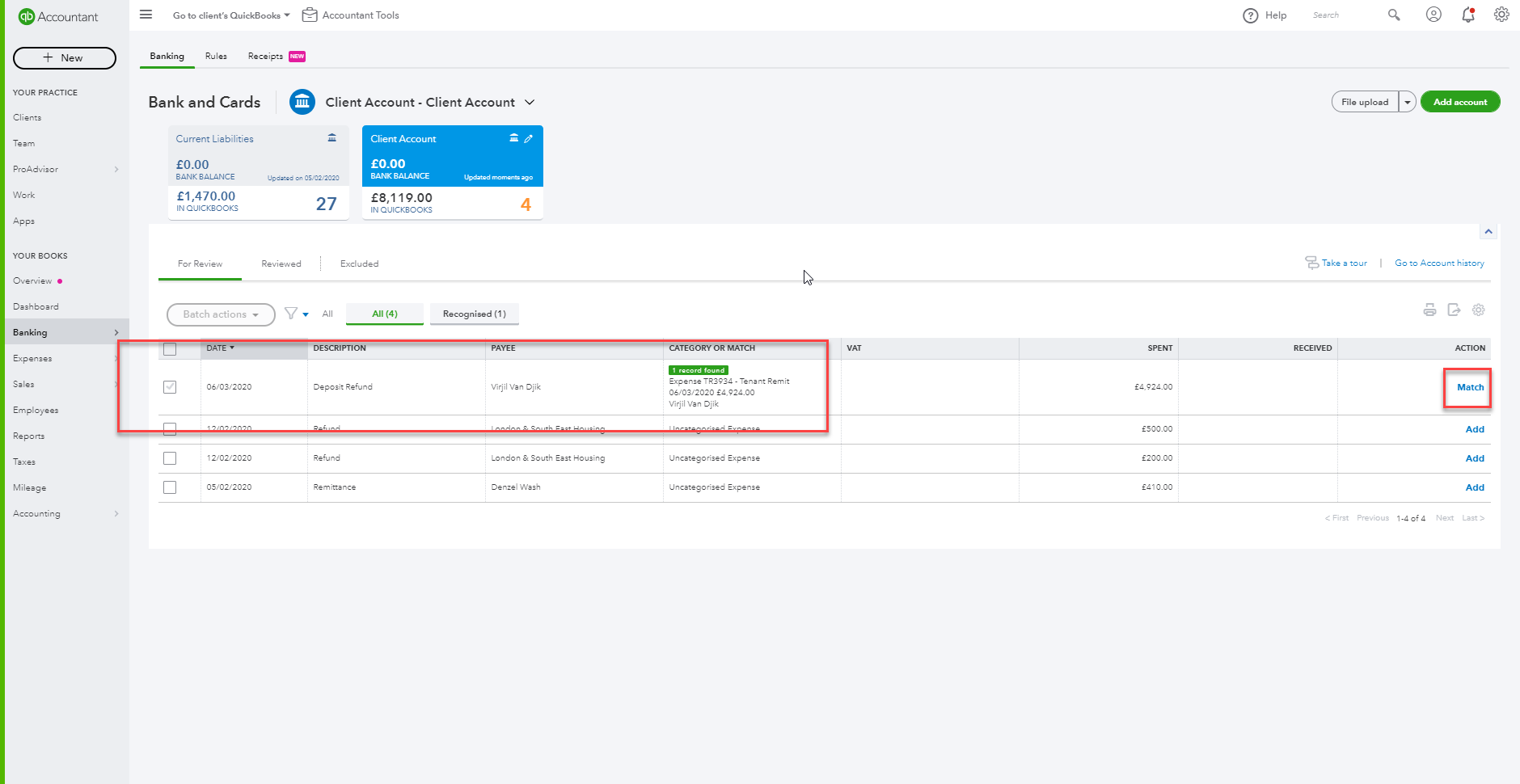

Financials & ReportingAll your property financials & reporting within one simple software

Financials & ReportingAll your property financials & reporting within one simple software Applicant Viewing & ManagementManage applicants & viewings seamlessly with our easy to use tools

Applicant Viewing & ManagementManage applicants & viewings seamlessly with our easy to use tools Task ManagementBringing sanity to chaos with our effortless task management features

Task ManagementBringing sanity to chaos with our effortless task management features Property ManagementFor all property types from commercial to residential and block management

Property ManagementFor all property types from commercial to residential and block management Stakeholder ManagementConnect with stakeholders from anywhere using Arthur’s suite of mobile apps

Stakeholder ManagementConnect with stakeholders from anywhere using Arthur’s suite of mobile apps Document ManagementTake full control of your document management in one secure place

Document ManagementTake full control of your document management in one secure place Occupancy ManagementMaking the occupancy process as smooth as possible from start to end

Occupancy ManagementMaking the occupancy process as smooth as possible from start to end Workflow ManagementGet the job done, quickly, efficiently with our workflow management tools

Workflow ManagementGet the job done, quickly, efficiently with our workflow management tools

- Solutions

- Pricing

- Help & Resources

- Arthur Insight

- BOOK DEMO

+44(0)20 7112 4860

+44(0)20 7112 4860