How to reduce costs of managing a rental property

To the uninitiated, managing a rental property may seem simple: 1. find a tenant, 2. watch the money roll in. But anyone who’s ever dabbled with being a landlord will tell you it’s not that simple.

Issues arise at random, tenancies end, insurance is complex and regular inspections are needed. That’s all assuming things go well; major repairs and evictions can quickly sap hard won returns.

Despite rising house prices and new regulations that have squeezed returns to their limit, being a landlord still makes financial sense, but only if costs are kept to a minimum.

Below are a few strategies savvy landlords can use to make the numbers work.

Cut finance costs

The era of historically low interest rates has somewhat off-set a tax crackdown on buying property investments and a tax raid on landlord’s rental income.

Greater demand from tenants, rents that should rise with inflation and the long horizon for interest rate rises, mean many investors are still tempted by buy-to-let.

Mortgage rates at record lows are helping buy-to-let investors make deals stack up, and it makes even more sense to cut down on interest costs as buy-to-let mortgage interest relief is axed and replaced with a 20 per cent tax credit.

One way you may be able to shelter your portfolio from these changes is to incorporate, but this may limit the number of lenders available to you, and these lenders may charge more, negating the benefits of the move.

However, there is no denying that property investment companies are becoming increasingly popular, this has attracted major lenders to the market, meaning that companies can borrow at similar or even cheaper rates compared to those offered on personal mortgages.

Increasing your deposits or simply buying outright should also be considered, especially in an unpredictable climate where the threat of rising interest rates looms large; the accelerated returns earned from leveraging may be better suited to more stable markets.

Get creative with void periods

Void periods can quickly turn a good investment into a bad one, losing just a few months’ rent is equivalent to 15% plus of your revenue for the year, a tough pill for any business to swallow.

Property guardians are a novel solution to this problem, property guardians stay in vacant properties until a conventional tenant can be found. Guardians agree to leave at short notice and accommodate viewings. The guardians benefit from paying well below market rates and landlords continue to earn rent, albeit reduced.

But be warned, although guardians may agree to vacate at short notice in principle, it may be hard to enforce eviction with less than 4 weeks’ notice. Guardians are protected by the Protection from Eviction Act 1977 – and that they could argue this in court.

Get insured

Being a landlord can be an expensive business, and if you haven’t got the right cover, you’ll have to foot the bill if things go wrong.

A thorough landlords’ policy can include several useful features, such as buildings insurance, accidental damage cover and financial protection against loss of rent.

However, insurance is costly and oftentimes an unnecessary outlay. Whether you really need insurance will depend on the risk of your investment. For example, a high end, unfurnished, two-bed flat in a modern block, bought with cash, is unlikely to need building’s insurance (which is most likely included in the service charge anyway) whereas a large, furnished student house, bought with a mortgage will likely need all the protection available.

Landlords’ buildings insurance

Building’s insurance is one of the main types of cover that a landlord will need, it protects the bricks and mortar of the property.

For example, in the event of flood or fire, buildings insurance will cover the rebuilding costs.

This usually includes replacing kitchens units and bathroom suites, while some policies may also cover sheds, garages and other outbuildings.

Landlords’ contents insurance

Contents insurance is another vital piece of cover, particularly if your property is rented fully or part-furnished.

This will protect your beds, carpets, sofas, TVs and other possessions from theft or damage.

It’s also possible to get extra cover for accidental damage, which could be anything from a smashed mirror to a coffee stain on an expensive rug.

Look for a policy that will replace your belongings on a “new for old” basis, which means your possessions will be replaced with new ones, should you make a claim.

And remember, you don’t have to insure your tenants’ possessions – that is their responsibility.

Landlords’ liability insurance

Liability insurance can be added as an extra to most policies and is often a requirement if you offer student or social housing.

It will cover you against tenants who may try and sue you for an accident that occurs on your property.

As you often won’t know who is coming back and forth, it can be invaluable for protecting you in the event of injury or death on your property.

Rent guarantee insurance

Rent Guarantee insurance is optional cover that helps to protect landlords from being at risk if tenants have difficulty paying their rent, and can be an invaluable policy for landlords who rely on the rental income to pay the mortgage

Legal expenses insurance

You may also want to consider covering yourself for any legal costs following potential disputes with tenants, including evicting squatters and repossessing your property.

Legal expenses insurance can also cover the cost of defending you against any criminal action.

You might be able to extend your policy to cover the legal costs of recovering any outstanding rent owed by your tenant, so always check the details of your policy.

Landlords’ home emergency cover

Emergency cover will cover the cost of arranging emergency repairs following, say, a gas leak, burst pipe, break-in or pest infestation at your property.

It ensures a fully qualified tradesmen will be on hand to sort out household emergencies, 24 hours a day, 365 days a year.

Look after your property

Not only does good maintenance mean that you are more likely to be compliant with ever changing health and safety regulations, your insurance company may also require certain parts of the structure, such as the roof, to meet certain standards.

Having a well-kept property will cut down on costly repairs, by spotting potential issues and avoiding them, and can even lower insurance premiums.

You’ll also have happier tenants, who are likely to stay longer and be more amenable to rent rises, and if they do leave, you will improve the chances of quickly finding new tenants.

Use new technology to be hands on

Despite the potential headaches, many landlords still take the hands-on approach, avoiding significant letting agent fees in the process.

Active landlords are becoming increasingly common place, encouraged by a range of advanced property management systems that help keep track of the myriad issues that arise.

Whether adopting a fully DIY approach, or outsourcing property management to a third-party, one thing is for sure – technology can help with property management and reduce costs.

With advances in technology, property management has never been easier, and new property management apps mean that everything can be run via your phone, giving you a direct platform of communication to take care of all your property management needs.

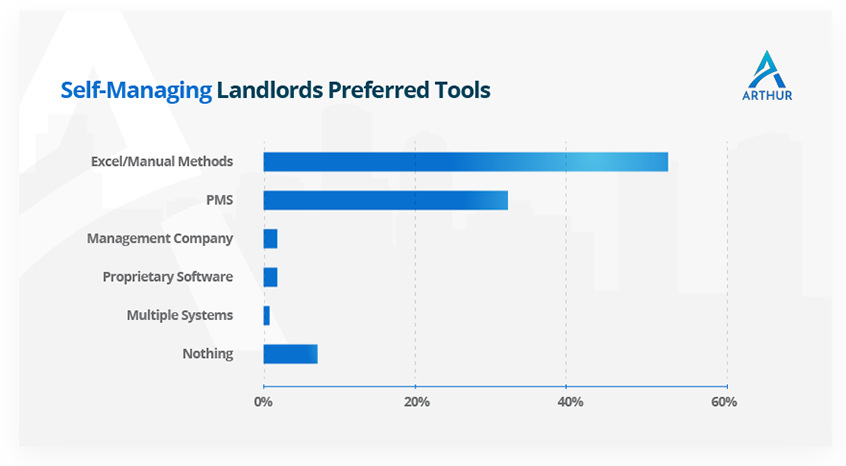

The chart below shows that Microsoft Excel and manual methods are still the weapon of choice for most self-managing landlords, but property management software is close behind as the next most favoured option. As these platforms improve, growth in the adoption of this new technology will only continue.

Source: Software Advice

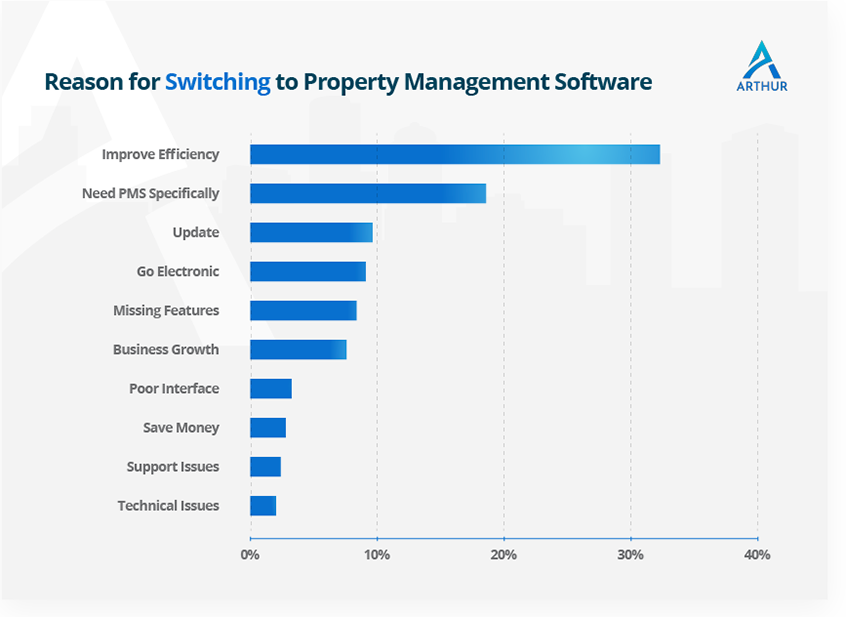

One of the great things about new platforms is the ability to streamline tenancy management. Instead of using Excel spreadsheets and other disconnected programmes, property management software allows everything to operate under one roof. According to the next chart, the number one reason for people switching to property management software is to improve efficiency and have everything in one place.

Source: Software Advice

House price rises have priced most people out of London property investment, but some areas of the UK are still to regain the ground lost after the financial crisis slump and investors are increasingly looking there for stronger returns. As property management software is web-based, it allows you to manage your properties from anywhere in the world, potentially opening the best investment opportunities, which are unlikely to be in your local area. Even if you use a local letting agent, it’s always best to keep an eye on things, property management software can give you that peace of mind.

Going digital with property management means data collection and storage have become much easier, and you can track payments from tenants to ensure that they are paying on time, and quickly spot any problems.

Property management software also acts as a platform of communication between the landlord, the tenants and contractors. Tenants can use dedicated apps to raise contractor workorders or tell if they have issues with their rent.

No matter what type of property is being rented, whether you are a landlord with one property or a large portfolio, having everything in one place makes tracking easier and improves communication, ultimately saving time and money.

Why not give Arthur a try?