The Top 6 Challenges in Commercial Property Management

Commercial property can be an excellent investment, but the responsibilities involved are substantial compared to other property investments. As a result, many commercial property owners have chosen to hire property management services. The following blog provides examples of just a few challenges faced by self-managing commercial property owners, and how it is possible to overcome these.

1. Choosing the right property

Commercial investment opportunities are no longer to be found in the high street and this has left the future of retail property uncertain. In contrast, there has been a huge growth in the industrial warehouses sector to cater for online deliveries. The latest figures from the RICS estimate that rental growth for industrial space could reach as high as 35%.

There are a number of different investment options within commercial property, including business, leisure, retail, industry, health and education. Each asset class is different, and requires a different approach to lease terms.

Unlike residential properties, commercial properties are not usually advertised by high street agents. The majority are sold through a private treaty or at an auction. If you are new to commercial property, it may be worth instructing a good commercial agent with investment expertise to help you started.

2. Finding the right tenants

It is important to understand who your potential tenants are, their industry and what their business objectives are. This is so you can ensure they are the right fit for you and your property.

Leasing out your commercial spaces should not be rushed. The risk is much higher with longer leases so you really want to make sure your tenants are aligned to your personal goals – it is not just about who can pay their bills on time.

If you have multiple lets, it is also important to consider your current tenants’ competitors, especially if you are considering retail spaces. You don’t want competing businesses to be situated close to each other, so it is recommended you get a good variety of businesses for your portfolio.

3. Freehold or leasehold?

Freehold is when you own all of the property (and the land attached), a leasehold is when the owner holds the interest for a certain period, limited to the length of the lease. Buying freehold will definitely be more expensive at first, but you are more likely to see higher returns in the long run.

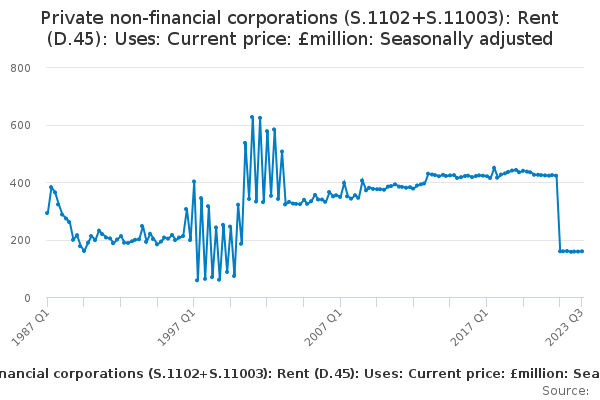

Source: Office of National Statistics

4. Securing a commercial mortgage

To purchase a commercial property, you may need to apply for a commercial investment mortgage. These usually last between 3 and 25 years. Since people tend to invest in commercial property with the intention of letting, these mortgages will take into account rental income and property value appreciation. It is worth doing your research into what mortgage is the right one for you.

5. Empty units and rent shortfalls

With commercial lettings, tenants tend to sign up for longer leases, which means they offer a more reliable income. However, this also means that commercial properties tend to experience larger void periods – it can take up to two years to replace a lost tenants. This is why it is important to attract the right tenants and, more importantly, know how to retain them.

Ensure your tenants understand the terms of their lease, are informed of any maintenance work that needs to be carried out and that you respond to any issues promptly. Commercial properties often require a great deal more repairs than buy-to-lets so it is important to be aware of your responsibilities.

6. Additional costs

Other costs you will have to consider alongside the initial purchase price include:

|

1 |

Stamp duty and land registry fees |

|

2 |

Surveyor, estate agent and solicitor fees |

|

3 |

VAT |

|

4 |

Building survey |

|

5 |

Environmental report |

There are some key differences between commercial and residential property investments, but as long as you do your research, commercial investments are able to offer some very healthy returns. Commercial properties offer rental yields from anywhere between 5% and 12%, which is much higher than the sub 5% that residential property offers.

If you are looking to diversify your portfolio, commercial property can be a great way to invest your money, particularly if you are looking for opportunities outside of London.