Arthur Online’s guide to credit checks

1. Why is it important to credit check your tenants?

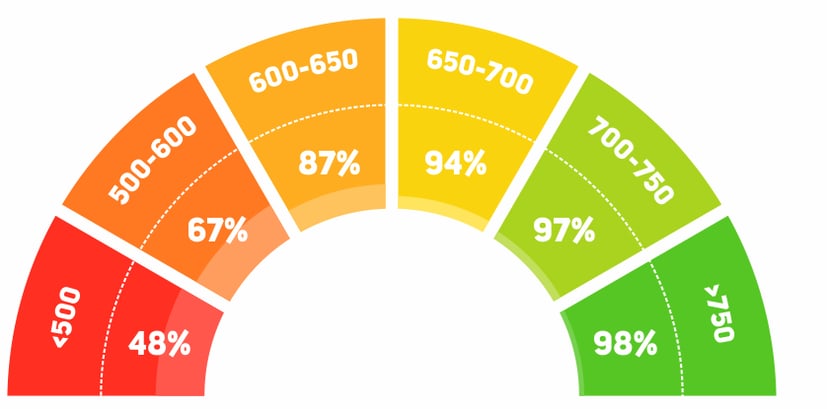

Prior to renting out your property, it is important to credit check your prospective tenant. A credit check provides information regarding the tenant’s financial history when it comes to levels of debt and paying back loans and bills.

With this information, landlords can then make an informed decision about whether or not to rent out their property to the individual. If there are County Court Judgements (CCJs) or insolvency solutions on the credit report, this serves as a key red flag, and highlights the tenant as high risk.

In summary, the benefits of credit checks are to:

(up to 10 addresses will be listed that have a financial link)

2. What information is taken into account with a credit check?

There is often confusion on the difference between reference and credit checks. Ultimately, they are both used to gather research on the trustworthiness of a tenant prior to a rental agreement being signed. However, while references are important for proof of character, credit checks are solely used to show a tenant’s financial history.

Unlike with mortgage lenders, landlords are unable to see credit account history and past credit applications. In a credit check you are not able to see how much money is in their current account, their salary or any student loans they may possess. You are also unable to access information regarding criminal or medical history, unlike with a tenant reference.

We’ve put together a feature comparison list for you to see the difference between what credit checks and tenant references offer:

| Features | Credit Check | Full Reference |

| Will look into a prospective tenant’s credit history |

✓ |

✓ |

| Previous employers and landlords will be contacted for the report |

✓ |

|

| Involves a soft and a hard search to gather information |

✓ |

|

| A report can be produced instantly |

✓ |

|

| Requires written permission to be carried out |

✓ |

✓ |

| Confirms proof of residency |

✓ |

✓ |

| Price competitiveness |

✓ |

|

| Involves confidential information |

✓ |

✓ |

Instead, a credit check is more of a ‘soft-search,’ which only includes information held on public registers. With a credit check you are allowed access to a variety of information which includes, but isn’t exclusive to: how much the tenant owes lenders, any past late/missed payments, whether they are on the electoral roll, any County Court Judgements (CCJs) and whether they have been declared bankrupt.

Before you run a credit check, you must get written permission from the prospective tenant since it will reveal their confidential information. While tenants do not have to agree to a credit check, without one they may not earn the confidence of their new landlord.

3. What could happen if you choose not to carry out credit checks?

It is recommended that landlords carry out credit checks on all potential candidates wanting to rent their property. Failure to run credit checks can exposes you to more risk. Particularly for small and medium sized businesses, if rents are continually paid late, they may run into cash flow problems. Without ensuring your tenants have a good credit history, you run the risk of not receiving rent payments, meaning you might be more likely to have to carry out evictions.

Dealing with rent arrears can be tough, and a credit check can mitigate the most obvious risks. If you do not carry out credit checks, you may find that you face more disputes and shorter tenancy periods.

4. How is technology making things easier?

Today’s digital age has made sourcing information much simpler. With data more easily accessible, there is greater transparency between landlord and tenant. As a result, better trust between the two can be built even prior to the tenant moving in.

Thanks to new technology, there is also software available which can carry out the credit check process almost instantaneously. They can be used by themselves, and increasingly many credit checks are available through property management software.

5. Conclusion

Surprisingly, credit checks are not universal in property industry, but they provide great value to landlords. They provide the most basic insurance against taking on tenants with a high likelihood of not paying their rent.

Its not a substitute for a tenant reference, which provides more detail on a potential tenant’s background, but it has a great value on its own:

|

1 |

They are very quick and gets a result back to you within moments |

|

2 |

They are affordable |

|

3 |

They provide you with the most rudimentary credit information on a potential tenant |